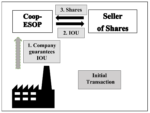

When is a “Coop” not really a cooperative? The short answer is whenever the actual activity of the “cooperative” is not carried out by the members but by employees. The problem is, of course, not in cooperation per se but in the hiring, employing, renting, or leasing of people to carry out the supposedly “cooperative” activities of the “cooperative.”

Fallacies about corporations

This article comments on Isabelle Ferreras’s “Democratizing the Corporation.” The focus is on the conceptual framing, which arguably contains a number of problems that are quite common on the left and are thus doubly deserving of commentary and explanation.

Opening the gates to Plato’s Heaven

The recipe to “open the gates to Plato’s Heaven” is by minimizing

the role of rivalrous substance and maximizing the role of non-rivalrous form. This creates a whole

series of different processes, positive feedback processes, vicious or virtuous circles, cumulative

circular causality, and increasing returns phenomena, which are analysed in this paper.

Historical and Modern Arguments about Contractual Slavery

The overall conclusion is that any institution or practice—human trafficking is a modern case in point—that, in effect, treats a person as a non-person, as only a means instead of as an end-in-themselves, violates their inalienable rights and is illegitimate, even with consent.

Intrinsic versus Extrinsic Motivation

This paper reviews some of the classic authors and literature on the subtleties of intrinsic motivation in the human activities where a presumed ‘helper’ (teacher, manager, social worker, etc.) are working with a certain class of ‘doers’ (students, workers, clients, etc.).

Is “Capitalism” a Misnomer? On Marx’s “capitalism” and Knight’s “civilization”

This is an open access article from the European Journal of the History of Economic Thought.

The name “capitalism” derives from Marx’s false analogy between medieval land ownership and the “ownership of the means of production.” However, unlike medieval land, capital goods can be rented out, e.g., by Frank Knight’s entrepreneur, and then the capital owner does not hold those management or product rights. What then is the characteristic institution in our civilization? It is the voluntary renting of workers. What then is the relationship between Classical Liberalism, the dominant philosophy behind Economics, and a lifetime labor contract? Frank Knight had plenty to say against the doctrine of inalienable rights which disallows such contracts.

Finding the Markets in the Math: Arbitrage and Optimization Theory

This is Chapter 10 from my book: Ellerman, David. 1995. Intellectual Trespassing as a Way of Life: Essays in Philosophy, Economics, and Mathematics. Lanham MD: Rowman & Littlefield.

One of the fundamental insights of mainstream neoclassical economics is the connection between competitive market prices and the Lagrange multipliers of optimization theory in mathematics. Yet this insight has not been well developed. In the standard theory of markets, competitive prices result from the equilibrium of supply and demand schedules. But in a constrained optimization problem, there seems to be no mathematical version of supply and demand functions so that the Lagrange multipliers would be seen as equilibrium prices. How can one “find the markets in the math” so that Lagrange multipliers will emerge as equilibrium market prices?

Are Marginal Products Created ex Nihilo?

This is Chapter 5 from my book: Ellerman, David. 1995. Intellectual Trespassing as a Way of Life: Essays in Philosophy, Economics, and Mathematics. Lanham MD: Rowman & Littlefield.

When an orthodox economist considers the principle of people getting the fruits of labor, he or she will invariably interpret it in terms of marginal productivity. The orthodox claim is that under the conditions of competitive equilibrium, each unit of labor “gets what it produces.” Well-meaning capitalist liberals emphasize that actual capitalism may be neither competitive nor in equilibrium, and in any case, there are enormous difficulties in measuring the “marginal product of each factor of production.” In other words, they accept that interpretation of marginal productivity theory in principle but fuss about its applicability in practice.