This is a presis of my book Helping People Help Themselves: From the World Bank to an Alternative Philosophy of Development Assistance. (U. of Michigan Press, 2005) I explore several principles or themes of a theory of autonomy-compatible assistance and show how these themes arise in the work of various authors in rather different fields.

Review of Thomas Dichter’s “Despite Good Intentions: Why Development Assistance to the Third World has Failed”

Development in Practice. August 2003.

Four Enterprise Creation Schemes: Putting Jane Jacobs to Work

This note presents policy ideas about entrepreneurship and enterprise creation derived from or, at least, inspired by Jane Jacobs’ writings.

Micro-Finance and other Development Fads

These are the slides for a 2012 talk given at USC along with Milford Bateman and Lamia Karim on mircofinance.

Parallel Experimentation

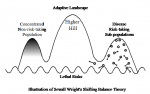

This is an unpublished working paper about the process of parallel experimentation which I take to be a process of multiple experiments running concurrently with some form of common goal, with benchmarking comparisons made between the experiments, and with the “migration” of discoveries between experiments wherever possible to ratchet up the performance of the group.

Good Intentions: The Dilemma of Outside-in Help for Inside-out Change

This article in the Non-Profit Quarterly applies some of the key lessons from development philosphy (in my Helping book) to the community development work of foundations.

Austrian capital theory and bourgeois paternalism

As pointed out by Lenore Ealy in her recent blog, there is an interesting connection between a couple of articles in the July 10, 2012 issue of The Freeman. One article by Peter Lewin was a critique of Keynesian stimulus/job creation programs from the viewpoint of Austrian capital theory. The creation of capital and enterprises is a roundabout time-consuming process, and cannot be a quick response to a government stimulus program. The other article by Sandy Ikeda makes a similar point with respect to the bourgeois paternalism of government programs to remake troubled communities since “no government can create what can only emerge spontaneously. That includes genuine communities, warts and all, instead of unsustainable projects and ‘Disneyland neighborhoods.’”

New Instant Cities: The Über-Planners of Libertarianism

This posting is in the series with the theme of libertarians (or classical liberals in the European sense) being unable to stick to their own fine principles whenever it is ideologically inconvenient (as if the fine principles were not their primary motivation!). An earlier blog posting as well as published papers made the point about the whole anti-social-engineering theme of so much libertarian thought (e.g., Hayek and Austrian economics). That theme was much applied to criticize the social planning of socialism in the transition from a capitalist or pre-capitalist society to some form of socialism. But when real-existing socialism collapsed in the late 1980s and early 1990s, liberal neoclassical economists (e.g., the Harvard wunderkinder such as Sachs, Summers, and Shleifer) pushed the strategy of “shock therapy” which involved massive social engineering in the transition from socialism to some form of a private property market economy. Instead of sticking by their fine anti-social-engineering principles, the libertarians, Hayekians, and Austrians suddenly fell silent since it would be ideologically inconvenient to appear as opposing the (shock therapy) transition to capitalism.