Where did the ideas behind the inalienable rights theory emerge in the history of thought?

Inalienable Rights: Part I The Basic Argument

What is the inalienable rights theory that descends from the Reformation through the Enlightenment and that answers the classical apologies for slavery and autocracy based on implicit or explicit voluntary contracts?

The fatal flaw in finance theory: Capitalizing “goodwill”

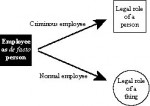

The fatal flaw at the root of today’s post is really what might be called “the fundamental myth” about the current property system, namely that the market-contractual role of being the residual claimant in a productive opportunity is treated as a “property right” that is currently owned by some legal party (e.g., the corporation having the contractual role) and that may be bought and sold as well as capitalized into the party’s current valuation.

The Fatal Flaw in Cost-Benefit Analysis

In Part I of this commentary on the Sarkozy-Stiglitz Commission on the Measurement of Economic Performance and Social Progress, the focus was on the social engineering perspective underlying the search for such an index. But at the end of that commentary, I noted that the Commission’s discussion of different indices was rather “academic” since there is one dominant index used in governmental decision-making: the monetized gains minus the monetized losses of cost-benefit analysis. A proponent of cost-benefit (CB) analysis would roll up all the Commission’s discussion into the question of the better “costing out” of all the direct and indirect impacts of a social decision.